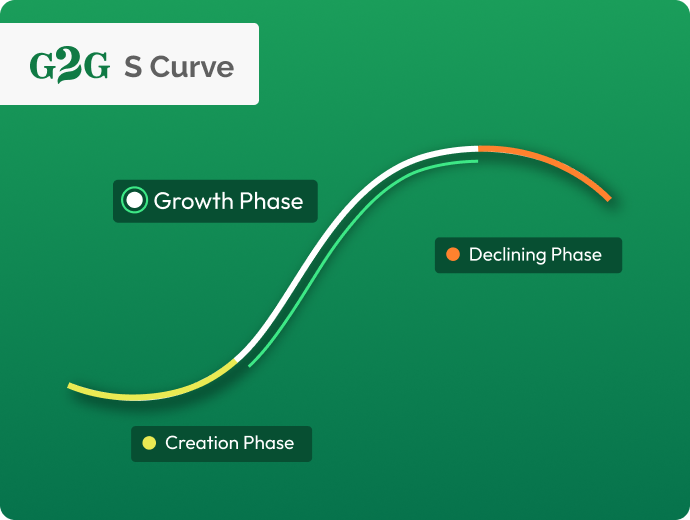

Edelweiss Public Alternatives is an investment management business and a part of the Edelweiss Group. We believe businesses, like everything, are cyclical and have two distinct phases. They go from Good-to-Great (1), become big, expensive, loved by all; then they go from Great-to-Good (2).

As investment managers of our clients’ assets, we want to own businesses in the Good-to-Great phase: our BUY discipline. But our job doesn’t end there. We want to protect capital by avoiding the massive losses of mind and money that Great-to-Good phases bring. This is our Sell or Say NO discipline.

We generate value for our clients by sticking to our G2G framework, keeping discipline in our Buy/Sell process and being intellectually honest to acknowledge and learn from our mistakes.

Edelweiss is a diversified financial services company with seven independent and well-governed businesses. The businesses include Alternative Asset Management, Mutual Fund, Asset Reconstruction, Lending, Housing Finance, Life, and General Insurance. The businesses have robust operating platforms, dedicated management teams, and strong boards that ensure the highest standards of governance. Edelweiss employs more than 6,000 people, serves around 76 Lakh customers, and manages over ₹2,10,000 Cr. worth of assets.

India is a top investment destination, offering size, growth, quality companies, and talent. As the world’s 5th largest economy, India’s GDP is $3.2 trillion, growing at 6-8%. With a young, optimistic population and a rapidly increasing per capita GDP of $2,500, India will supply the largest global workforce in the next two decades. 6,000+ listed companies provide diverse investment opportunities. As a democracy with a strong institutional framework, Indian talent leads global firms like Google and Microsoft. Indian stocks have consistently outperformed other emerging markets over the past two decades.

PMS Strategies

Our team of seasoned experts is dedicated to delivering exceptional alternative investment solutions.

Ajay Sharma is a seasoned expert in fund management and equity research. He has a deep understanding and a successful track record of managing capital for prestigious institutions, endowments, foundations, and family offices. Before joining Edelweiss, Ajay was the Managing Partner at Calibrium Capital. His entrepreneurial spirit is evident from his founding roles at Flowering Tree Investment Management, mangotown.in.

His career also includes significant tenures at Asian Management (JH Whitney), CLSA, and JM Morgan Stanley, enriching his industry experience.

He is an alumnus of the Indian Institute of Management, Ahmedabad (IIM -A), complemented by a Bachelor of Pharmacy from the Indian Institute of Technology, Varanasi.

Ajay has a unique skill, he has analysed and invested in companies not just in India, but also China, Japan, Australia and South East Asia. He brings a truly global perspective to investing.

Ajay is an award-winning analyst. He was the top-rated analyst by Asiamoney & Business Today. He published some thought-provoking research of the healthcare industry and predicted severe price deflation in generics.

He has built businesses from scratch which include Asset Management, 3D Printing and Therapy Centres for special needs children.

Having been an entrepreneur himself and interacted with many, Ajay understands entrepreneurs, he can relate to the difficulty they face in building out businesses through all the ups and downs, the peaks and the valleys.

From the 25 years of being an investor and entrepreneur, Ajay has formulated a unique investment philosophy. The G2G Framework, Buy businesses during 1) Good-to-Great phases, and Avoid 2) Great-to-Good pitfalls. He believes everything is cyclical including businesses we invest in. His portfolio construction and risk management is driven by a disciplined and process driven approach, which leads to better investment outcomes.

Ajay is a voracious reader and tennis player.

Prolin Nandu is an accomplished expert in institutional equities with 14 years of experience in the industry. For 9 of those years, he was an integral member of GMO, where he played a vital role in managing an emerging markets fund valued at approximately USD 2.5 billion, with specific oversight of India exposure amounting to around USD 500 million. His extensive career encompasses tracking multiple sectors and companies across different market capitalisations.

Prolin possesses prestigious qualifications, holding both a CFA and an MBA, which enhanced his passion for investing. He advocates for the virtuous learning cycle that weaves together investment lessons with life experiences.

A strong proponent of the Indian narrative, Prolin is inspired by the belief that, if navigated wisely, India can secure decades of prosperity.

In his leisure time, Prolin finds comfort in fiction, immersing himself in engaging narratives and exploring new realms through literature. He dedicatedly follows football and F1, eagerly anticipating a mean reversion in Manchester United's fortunes and a turnaround in luck for Ferrari, especially with the possibility of Lewis Hamilton wearing the iconic red.

Prolin also enjoys travelling, seeking nourishment for his spirit through journeys across natural landscapes. Above all, he is captivated by the intricate tapestries of individual stories and the remarkable journeys they encompass.

Abhishek Modi is a seasoned professional with over 13 years of experience in the financial services sector. His career began with Bank of America’s Global Investment Banking Division, followed by key roles at Ambit Corporate Finance. Most recently, Abhishek was part of the Deutsche Bank Group, where he held pivotal responsibilities within Global Credit Risk Management's COO Office.

His deep understanding of BFSI spans investment banking – including origination and advisory – as well as business finance and risk management. Beyond BFSI, he ventured into the luxury retail space for four years, leading his own entrepreneurial endeavour.

Abhishek holds esteemed academic credentials with both a B.Tech and M.Tech in Mechanical Engineering from IIT Bombay, and an MBA in Finance and Strategy from ISB Hyderabad, solidifying his strong foundation in both technical and financial expertise.

Outside the professional sphere, Abhishek enjoys travelling, watching sports, and spending quality time with his 7 year-old son. He finds joy in exploring new places and cherishes moments spent creating lasting memories with his family.

Viral Mehta brings nearly 8 years of comprehensive experience in finance and equity research. His career began with 3.5 years in banking, undertaking credit and product management, before delving into the nuances of the Indian equities market. At Ambit, Viral learnt to weave narratives from data, connecting numbers to compelling stories. His tenure at PPFAS underscored the importance of value investing and cultivated his patience in the market.

Viral holds a Chartered Accountant designation and has successfully cleared three levels of the CFA programme. His curious spirit drives him to explore intricate business models and their surrounding ecosystems, enabling informed decision-making.

Beyond finance, Viral is fascinated by the myths and stories of ancient civilisations, particularly those of Atlantis and Dwarka, in the context of global sea level changes over time. In his leisure, he enjoys visiting historical sites and natural wonders, marvelling at Earth's delicate balance to sustain life. Neil Armstrong's immortal words, "That's one small step for man, one giant leap for mankind", resonate deeply with him, encapsulating the profound impact of human exploration and discovery.